⚠︎

Permissionless lending built on Uniswap.

Aloe puts liquidity to work by connecting lenders and market-makers.

Fully open-source, governance-minimized, and powered by Uniswap.

Backed by the best

Features

Innovative architecture

Thoughtfully designed for your safety and security while pushing the space forward.

Dynamic LTVs

The market is always changing, so LTV should too. The onchain volatility oracle can push up to 6 updates per day.

Liquidation warnings

Sign up to receive Telegram notifications before your account is liquidated so you can avoid penalties.*

Robust oracles

Uniswap V3 TWAP plus built-in manipulation detection means you can sleep soundly.

Dutch auctions

The liquidation flow uses gradual Dutch Auctions to minimize your losses and maximize efficiency.

Customizable risk

Isolated markets mean one bad token can't ruin the bunch. Lend only to pairs you're comfortable with.

Governance minimized

Immutable contracts and just 5 parameters to tweak. Core functionality works with or without governance.

Features

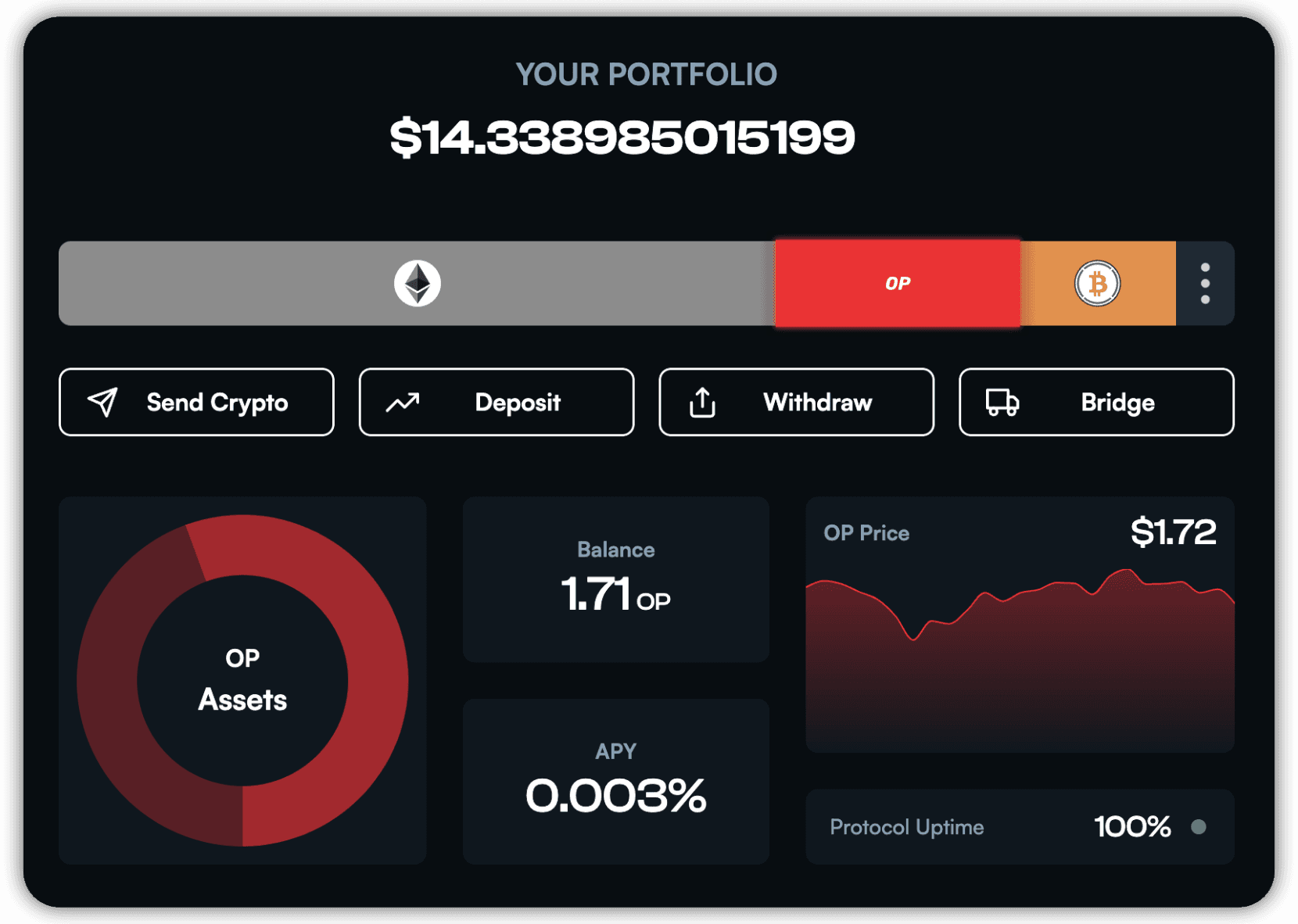

Powerful UI

We strive to bring you an exceptional user experience so that you can benefit from Aloe's decentralization without compromise.

Features

Flexible protocol

Providing you with the tools and information you need to handle hundreds of tokens across multiple chains.

Unified portfolio

The portfolio page helps you interact with the protocol, viewing compatible tokens and managing deposits all in one place.

Manipulation: 14 < 578

14.12%

Transparent oracle

Keep tabs on oracle health and manipulation status through the UI.

Built for Ethereum

Duplicate file

Multichain deployment

Works anywhere there's Uniswap V3 liquidity. Live on Opt, Arb, and Base.

Aloe Bot

/help

Helpful bot

Get notified before liquidation.* Additional capabilities soon™️

Familiar analysis

Benefit from a rich ecosystem of Uniswap research and analysis.

FAQ

Some things you may want to know

We answered questions so you don’t have to ask them.

Do you charge any fees?

What if everyone tries to withdraw at once?

How do you make sure borrowers are solvent?

Who can be a lender? Who can be a borrower? Who can be a liquidator?

Will I earn a fixed interest rate, or does it change over time?

How is Aloe different from AAVE?

Blog

Latest from our blog

Stay up-to-date on all things Aloe, from frontend features to research and our philosophy on building open-source software.